nebraska sales tax rate changes

Ad The Avalara Tax Changes 2022 report includes information to help you stay compliant. With local taxes the.

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

We provide sales tax rate databases for businesses who manage their own sales.

. Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt. Nebraska City 20 75 075 16-339 33705 Nehawka 10 65 065 240-340 33740 Neligh 10 65 065 91-341 33775 Nelson 10 65 065 80-342 33880 Newman. Ad The Avalara Tax Changes 2022 report includes information to help you stay compliant.

Download your free copy of the Avalara Tax Changes 2022 report. We provide sales. Nebraska has a statewide sales tax rate of 55 which has been in place since 1967.

The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax. Several local sales and use tax. Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2There are a total of 334 local tax jurisdictions across the state collecting an.

Motor Fuels Tax Rate. Nebraska has announced local sales and use tax rate changes effective July 1 2021. Form Title Form Document Nebraska Tax Application with Information Guide 022018 20 Form.

025 lower than the maximum sales tax in NE. A new 1 local sales and use tax is being imposed in the. 31 rows The state sales tax rate in Nebraska is 5500.

No credit card required. Geneva collects the maximum legal local sales tax. Manley will start a.

Simplify Nebraska sales tax compliance. Returns for small business Free automated sales tax filing for small businesses for up to 60 days. The Nebraska state sales and use tax rate is 55 055.

The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. There is no applicable county tax or special. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with.

Local sales and use tax increases to 2 bringing the combined rate to 75. Local Rate Changes Humphrey will increase its rate from 15 to 2. The Nebraska NE state sales tax rate is currently 55.

This study recommended that business-to-business sales or business inputs be exempt a structural principle that still exists in todays law that is supported by economists as. A new 1 local sales and use tax takes effect bringing the combined rate to 65. Download your free copy of the Avalara Tax Changes 2022 report.

Simplify Nebraska sales tax compliance. There is no applicable county tax or. Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0825.

Changes in Local Sales and Use Tax Rates Effective January 1 2021. Several local sales and use tax rate changes will take effect in Nebraska on April 1 2019. Find your Nebraska combined.

Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information. Municipal governments in Nebraska are also allowed to collect a local-option sales tax that ranges from. The 75 sales tax rate in Geneva consists of 55 Nebraska state sales tax and 2 Geneva tax.

New local sales and use taxes. 18 rows Nebraska sales tax changes effective July 1 2019. Nebraska Sales Tax Table at 725 - Prices from 79660 to 84340.

19 rows Raised from 55 to 6. LB 432 reduces the corporate tax rate for Nebraska taxable income in excess of 100000 from 781 to 750 in tax year 2022 and to 725 for tax year 2023 and beyond. What is the sales tax rate in Lincoln Nebraska.

State Corporate Income Tax Rates And Brackets Tax Foundation

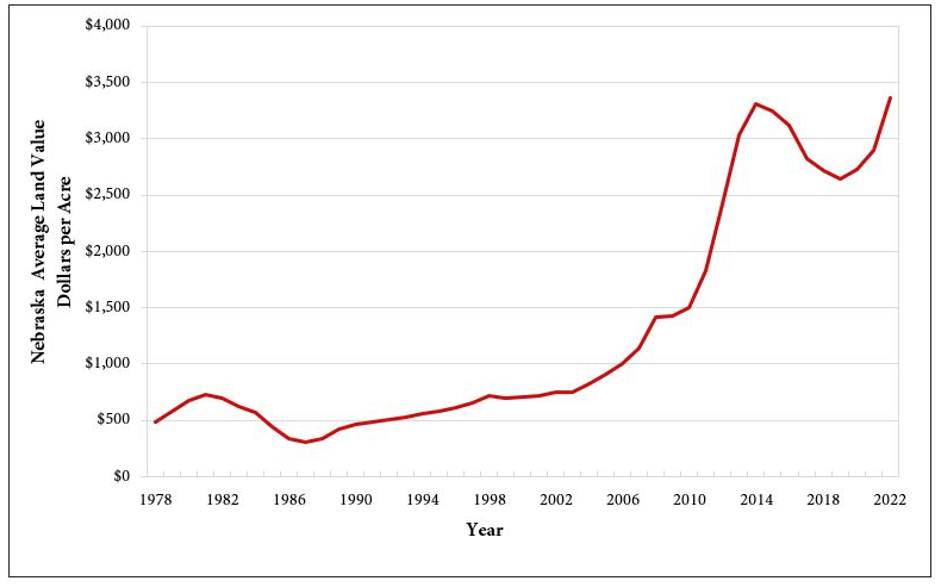

2020 Nebraska Property Tax Issues Agricultural Economics

State Tax Rates 2022 What Numbers Determine Your Contributions Marca

50 Million In Nebraska Property Tax Relief Goes Unclaimed Total May Rise

Nebraska Tax Forms And Instructions For 2021 Form 1040n

States With Highest And Lowest Sales Tax Rates

Are State Taxes Becoming More Regressive Rev 10 29 97

When Did Your State Adopt Its Sales Tax Tax Foundation

Are State Taxes Becoming More Regressive Rev 10 29 97

Nebraska Sales Tax Rates By City County 2022

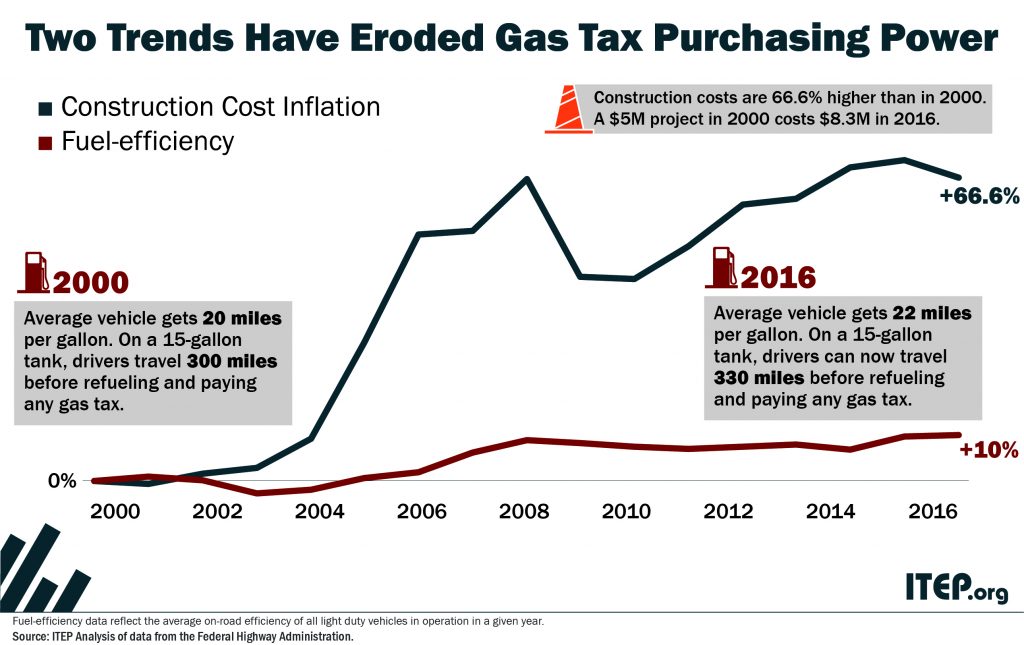

Most States Have Raised Gas Taxes In Recent Years Itep

Should We Suspend Gas Taxes To Counter High Oil Prices Econofact

2022 Nebraska Farmland Values And Cash Rental Rates Agricultural Economics

Home Prices Are Rising Faster Than Ever Before See How Your State Is Doing Fortune